Turbotax Cryptocurrency

Turbotax, the popular tax preparation software, now supports cryptocurrency. This means that users can now report their capital gains and losses from cryptocurrency transactions on their taxes. This is a big development for the cryptocurrency space, as it adds another layer of legitimacy and mainstream adoption.

How to Use TurboTax for Cryptocurrency Taxes

TurboTax is a popular tax preparation software that can be used to file taxes for cryptocurrency transactions. The first step is to create an account on TurboTax. Once you have created your account, you will need to connect your Coinbase account.

Once you have connected your Coinbase account, you will need to input your bitcoin and cryptocurrency transaction information into the TurboTax software. TurboTax will then generate a tax return for you based on your information.

Get the Most Out of TurboTax for Cryptocurrency Taxes

TurboTax is an online tax preparation software that helps taxpayers with their federal, state, and local taxes. It can help you file your taxes for cryptocurrency taxes using its Tax Preparation software.

Here are some things to keep in mind when using TurboTax to file your cryptocurrency taxes:

1. You will need to know your cryptocurrency holdings and profits.

TurboTax will ask you a series of questions about your cryptocurrency holdings and profits in order to determine your taxable income. You'll need to account for all of your cryptocurrency holdings, including any coins, tokens, and other digital assets that you own.

2. You will need to understand the tax rules for cryptocurrency transactions.

The tax rules for cryptocurrency transactions are complex, so it's important to have a good understanding of them if you want to file your taxes using TurboTax. TurboTax will walk you through the basics of cryptocurrency taxation, but you'll still need to be familiar with the tax code in order to file your taxes correctly.

3. You will need to file your taxes using TurboTax.

Filing your taxes using TurboTax is the best way to get your taxes done correctly and ensure that you're getting the most out of your cryptocurrency investments. TurboTax offers a variety of filing options, so you can find the one that works best for you.

How to Save on Cryptocurrency Taxes with TurboTax

TurboTax is a popular online tax preparation software. It helps you to prepare your taxes for both federal and state taxes.

TurboTax offers a variety of cryptocurrency tax tips. Here are some of the most effective tips:

1. Use a Bitcoin IRA. A Bitcoin IRA is a special type of account that allows you to invest in Bitcoin and other cryptocurrencies. This can help you to avoid capital gains and income taxes when you sell your cryptocurrencies.

2. Track your taxes. Make sure you track your cryptocurrency transactions and gains so that you can properly report them to the IRS.

3. Don't forget about gift taxes. If you give someone cryptocurrency as a gift, you may have to pay gift taxes. Check with your accountant to see if you need to file a gift tax return.

4. Keep track of your expenses. Keep track of your spending on cryptocurrencies and other digital assets. This will help you to better understand your overall taxable income.

TurboTax: The Best Way to File Crypto Taxes

in 2019

Cryptocurrency taxation is an important topic for anyone with cryptocurrency holdings. Many people don’t realize that they need to pay taxes on their crypto holdings, and many people don’t know how to file taxes on their cryptocurrency holdings.

If you are a cryptocurrency investor, you should use a cryptocurrency tax filing service like TurboTax to file your taxes. TurboTax is the best cryptocurrency tax filing service because it is easy to use, it has a wide range of filing options, and it has a good reputation.

TurboTax is a free service, so you don’t have to pay anything to use it. TurboTax also has a variety of payment options, so you can use whatever payment method is easiest for you.

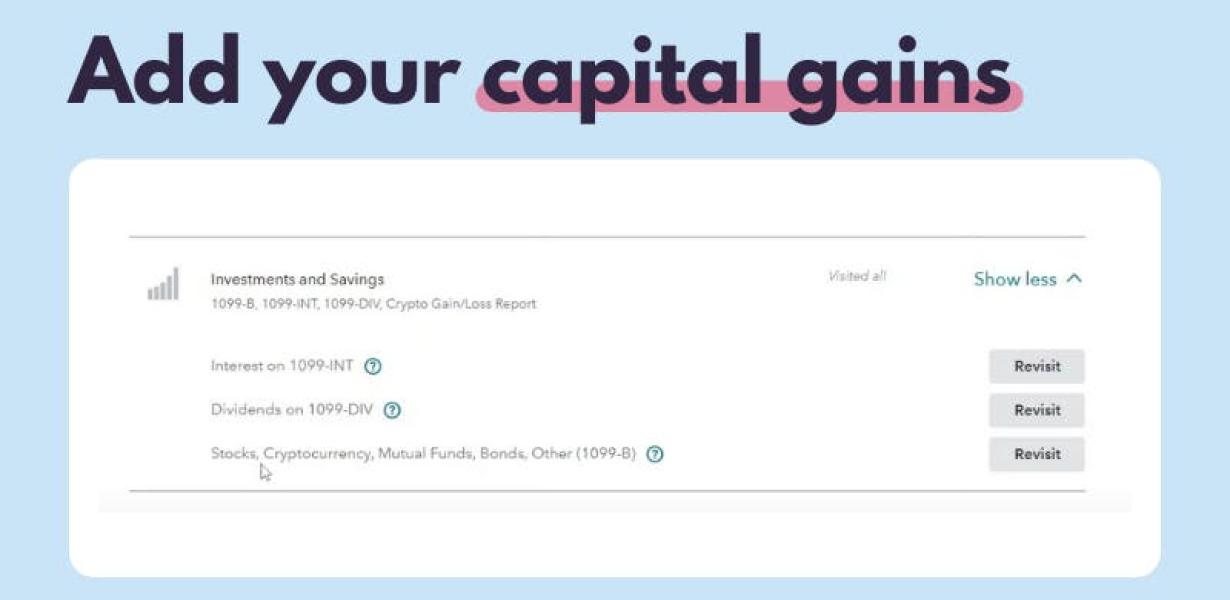

To use TurboTax to file your cryptocurrency taxes, first create an account. Then, select “Cryptocurrency” from the list of topics on the left side of the screen.

On the “Cryptocurrency” page, click the “File Your Taxes” button.

On the “Cryptocurrency Tax Filing Options” page, click the “Start Your Taxes” button.

On the “Cryptocurrency Tax Filing Worksheet” page, fill in the information about your cryptocurrency holdings.

On the “Taxes and Credits” page, click the “Next” button.

On the “Review and Finish Your Taxes” page, click the “Finish” button.

Your taxes will be filed, and you will receive a confirmation email.

The Ultimate Guide to Filing Cryptocurrency Taxes with TurboTax

TurboTax is the most popular tax preparation software in the world and it’s perfect for filing taxes with cryptocurrency.

Here’s a step-by-step guide on how to file taxes with TurboTax:

1. Open TurboTax and create a new account. If you have an existing TurboTax account, login.

2. On the “Quick Start” screen, choose “Cryptocurrency.”

3. On the “Cryptocurrency Tax Basics” screen, you’ll need to provide basic information about your cryptocurrency transactions. This includes the date of your transactions, the amount of cryptocurrency you transferred, and your digital wallet address.

4. On the “Taxes & Fees” screen, you’ll need to select your tax filing status and provide your Social Security number.

5. On the “Sources of Income” screen, you’ll need to select your source of income. This includes cryptocurrencies, traditional investments, and rental income.

6. On the “Income Taxes” screen, you’ll need to provide your tax filing status, taxable income, and deductions. You can also add a credit card or other loan interest deduction here.

7. On the “Payment Options” screen, you can choose to pay your taxes through TurboTax online or through a payment processor like PayPal.

8. On the “Review Your Filing” screen, you’ll be given the opportunity to review your taxes and make any changes if necessary.

9. Click “Submit Your Tax Return.”

10. TurboTax will generate your tax refund based on your tax filing status and income. You can receive your tax refund through direct deposit, PayPal, or a bank account.

How to File Cryptocurrency Taxes with TurboTax

TurboTax is the most popular tax preparation software for cryptocurrency investors. Follow these steps to file your taxes with TurboTax:

1. Open TurboTax and create a new account.

2. Select "Taxes" from the main menu.

3. Select "Cryptocurrency" from the "Type of Taxation" dropdown menu.

4. On the "Income Tax" page, select "Bitcoin, Ethereum, and Other Cryptocurrencies."

5. On the "Itemized Deductions" page, select "Cryptocurrency Losses."

6. On the "Tax Schedule" page, enter your estimated taxes and click "Calculate."

7. Review your taxes and make any changes.

8. Click the "Submit" button to submit your taxes.